The world of investing can be complex, and when navigating this world, certain metrics can serve as a guide for making informed decisions. Among many such metrics, the Price-to-Earnings ratio or PE ratio for short serves as an important tool. It provides you with a snapshot of the company’s value and helps you estimate whether a stock is overvalued or undervalued compared to its earnings. Understanding this ratio can provide you with insights into financial trends and offer insights into market sentiment. This metric is especially valuable for comparing companies within the same industry and assessing their attractiveness. Therefore, it is important to understand what the PE ratio is and its importance.

In this blog, we discuss what a PE ratio is, how to calculate it, and its significance. So, with this in mind, let’s get started!

A. Understanding PE Ratio

The price-to-earnings (PE) ratios are widely used financial metrics that help investors like yours examine the valuation of a company’s stock. It reflects the relationship between the company’s current share price and its earnings per share. Essentially, it indicates how much you are willing to pay for each rupee of the company’s earnings. A higher PE ratio suggests that the stock is overvalued or you expect good future growth and are willing to pay more for the stock. On the other hand, a lower PE ratio implies that the stock is undervalued or that the company is facing challenges. Although not definitive, this ratio serves as a comparative tool, allowing you, as an investor, to test the company’s valuation against other companies and its past performance.

By doing this, you can gain insights into market expectations and, therefore, can make more informed decisions about buying, selling, or holding stocks.

B. Process to Calculate PE Ratio

From what we have discussed so far, you may be able to guess that it consists of two variables: the existing stock price and earnings generated by the company. Now taking these two into account, the process of calculating is rather simple. All you need to do is divide the existing stock price by earnings per share of the company. In other words, the formula for calculating this ratio is as follows:

PE Ratio = Current Stock Price ÷ Earnings Per Share (EPS)

For instance, if a company’s stock is priced at NPR 1,000 and the EPS is NPR 100, the PE ratio would be 10 since 10 = 1,000 / 100. This indicates that you are willing to pay NPR 10 for every NPR 1 of the company’s earnings.

C. Types of PE Ratio

There are many types of PE ratios, each providing different insights into a company’s valuation and financial health. The two main types are as follows:

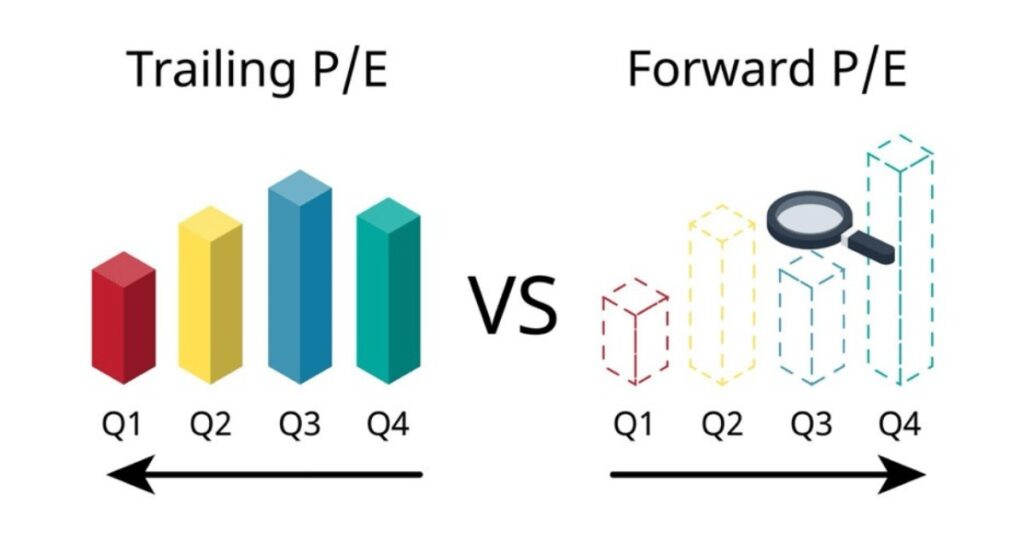

1. Trailing PE Ratio

This is a widely used metric that reflects a company’s stock price relative to its earnings over the past year. It uses real earnings data to offer a clear image of the company’s historical performance and market valuation. The ratio is highly beneficial for comparing companies within the same industries based on their past earnings. Furthermore, this metric also provides stability and a strong assessment of how the market values past performance. However, it may not account for future growth prospects or recent changes in the company’s operations or market conditions, which could affect its current valuation.

2. Forward PE Ratio

Forward PE Ratio calculates a projection of a company’s stock price relative to its expected earnings for the next 12 months or the next fiscal year. These forward-looking metrics help you examine potential future performance and growth prospects, making it especially useful for evaluating companies with strong growth and strong growth expectations. Unlike the previous one, the forward PE ratio is based on earning forecasts and, therefore, can offer insights into the future valuation. However, since it relies on estimates, it is often considered less reliable if projections are inaccurate or if significant changes impact the company’s future earnings.

D. Importance of PE Ratio

The Price-to-Earnings (PE) ratio is a key tool in investing that helps determine if a stock is fairly priced. It compares a company’s stock price to its earnings, giving you insights into the stock’s value. This is the key aspect of the price-to-earnings ratio. Besides this, some other key importance are:

1. Valuation Assessment

A PE ratio helps you understand if a stock is priced properly based on its earnings. By comparing its current ratio to its past value or ratios of similar companies, you can see if the stock is overpriced or bargained. This comparison is important because it guides you in deciding whether you are paying a reasonable amount or not. A fair ratio helps to ensure that you make informed decisions and avoid overpaying for stock or missing out on a good investment opportunity.

2. Investment Comparison

Another key importance of the PE ratio is investment comparison. This ratio gives a clear and consistent way to compare how stocks are valued within the same industry or sector. You can easily see which stocks are priced lower compared to their earnings by looking at the ratios of different companies. This makes it easier to spot a stock that offers better value for its price. In other words, this ratio helps you to find stocks where the price is reasonable compared to the company’s earnings.

3. Growth Expectations

Another key importance of the PE ratio is that it helps in showing the company’s future growth. A high ratio often means that investors like yourself believe in the positive growth of the company, while the reverse often signifies that the growth would not be significant or that the stock is priced too cheaply. By understanding these expectations, you can make better decisions about whether a stock is worth buying based on its growth prospects and existing price.

4. Financial Health Indicator

While not a comprehensive measure, the PE ratio can provide clues about a company’s financial health and profitability. A consistently high PE ratio may signal that the company is performing well and enjoying strong market confidence. On the other hand, a low PE ratio might indicate that there are potential issues or challenges that the company faces. Understanding these signals can help you dig deeper into a company’s financials to assess whether its current stock price truly reflects its financial health.

5. Market Sentiment Reflection

The PE ratio can also reflect broader market sentiment and investor confidence in a company. A rising PE ratio often signals growing optimism and positive sentiment about the company’s future performance, as investors like yourself are willing to pay more for its earnings. On the flip side, a declining PE ratio might suggest increasing concerns or negative sentiment about the company’s prospects, helping you estimate how market perceptions are evolving.

These are the five key importance of the PE ratio. Besides the ones we mentioned here, there can be several other importance of this ratio.

Conclusion

Price-to-earnings (PE) ratio is a financial metric that is used to help investors like yourself examine the valuation of a company’s stock. The formula to calculate this ratio is PE Ratio = Current Stock Price ÷ Earnings Per Share (EPS), and there are two main types of this ratio. These two main types are the Trailing PE ratio and the Forward PE ratio. Furthermore, this ratio has many importance. Some of the key ones include aid in valuation assessment, investment comparison, growth expectations, financial health indicators, and market sentiment reflection.

In this blog, we discussed what a PE ratio is, the method to calculate it, and its importance. We hope you found this helpful. If you want further details regarding various forms of securities, do check out some of our other blogs.

Want to know about commission and fees? Click below:

1. Trading Commission and Fees

2. Depository Participant Fees

And if you want the best service regarding the share market and securities in Nepal, look no further than Secured Securities, the best stock broker in Nepal. Thank you for reading till the end.

FAQs on PE Ratio and Its Importances

Q1. What is the PE Ratio?

The Price-to-Earnings (PE) ratio is a financial metric used to evaluate the value of a company’s stock relative to its earnings. A higher PE ratio may indicate that the stock is overvalued or investors expect strong future growth. In comparison, a lower PE ratio could suggest that the stock is undervalued or that the company may be facing challenges. It is a commonly used tool for comparing the valuations of companies, especially within the same industry.

Q2. What is the Importance of the PE Ratio?

The PE ratio is an essential tool in evaluating a company’s stock and offers several key benefits to investors:

● It helps determine if a stock is fairly valued by comparing it to historical data or similar companies.

● The PE ratio simplifies comparing companies within the same industry to find better-value stocks.

● It provides insights into what investors expect for the company’s future growth.

● The PE ratio offers clues about the financial health of a company.

● It reflects overall investor confidence and the market’s perception of the company’s future.

Q3. What value of PE ratio is regarded good for investment?

PE ratio is a relative measure. So, any absolute value of PE ratio may not be regarded as good or bad universally. In any particular scenario, PE ratio of 20 or less may indicate a good investment opportunity but it may not hold in all circumstances. PE ratio is inversely related to interest rate. So, in a very high interest rate scenario, the benchmark PE value should be taken at lower level and vice versa.

Q4. What are the two main types of PE ratios?

The two main types of PE ratios are the Trailing PE Ratio and the Forward PE Ratio. The Trailing PE Ratio uses past earnings data over the last 12 months, providing a clear picture of historical performance. The Forward PE Ratio uses projected earnings for the next 12 months or fiscal year, offering insights into future valuation and growth prospects.

Q5. What does a high PE ratio indicate?

A high PE ratio often indicates that investors expect strong future growth from the company. It suggests that investors are willing to pay a premium for the stock based on anticipated earnings increases. However, a high PE ratio can also mean the stock is overvalued compared to its current earnings. It’s important to consider industry norms and company-specific factors when interpreting a high PE ratio.

Q6. What does a low PE ratio suggest?

A low PE ratio might suggest that a stock is undervalued relative to its earnings. It could indicate that the market has overlooked the company’s potential or that the company is facing challenges. However, a low PE ratio doesn’t always mean a good investment, as it might reflect fundamental issues with the company. It’s crucial to investigate why the ratio is low before making investment decisions.

Q7. How does the PE ratio reflect market sentiment?

A rising PE ratio often signals growing optimism and positive sentiment about a company’s future performance. It indicates that investors are willing to pay more for the company’s earnings, suggesting confidence in its prospects. Conversely, a declining PE ratio might suggest increasing concerns or negative sentiment about the company’s future. This reflection of market sentiment can help investors gauge changing perceptions of a company over time.

Q8. Can the PE ratio indicate a company’s financial health?

While not a comprehensive measure, the PE ratio can provide clues about a company’s financial health. A consistently high PE ratio may signal that the company is performing well and enjoying strong market confidence. A low PE ratio might indicate potential issues or challenges the company faces. However, it’s important to use the PE ratio in conjunction with other financial metrics for a more complete assessment of a company’s financial health.

Q9. How does the Forward PE Ratio differ from the Trailing PE Ratio?

The Forward PE Ratio uses projected future earnings, while the Trailing PE Ratio uses past earnings data. Forward PE is more speculative as it relies on earnings forecasts, which may not materialize. Trailing PE offers a more stable assessment based on actual historical data. While Forward PE can provide insights into future growth expectations, Trailing PE is often considered more reliable due to its use of real data.